The online ads offer consumers a “risk-free trial” of skincare products from companies that claim to be accredited by the Better Business Bureau with an A- rating. How could that possibly be deceptive or unfair? Let us count the ways.

An FTC lawsuit filed in a California federal court alleges that an interconnected operation of 15 companies and 7 individuals uses trickery to get consumers to turn over their credit or debit card numbers and then bills people without their permission for merchandise advertised as a “risk-free trial.” What about the defendants’ claim of an A- rating with the BBB? False, says the FTC.

An FTC lawsuit filed in a California federal court alleges that an interconnected operation of 15 companies and 7 individuals uses trickery to get consumers to turn over their credit or debit card numbers and then bills people without their permission for merchandise advertised as a “risk-free trial.” What about the defendants’ claim of an A- rating with the BBB? False, says the FTC.

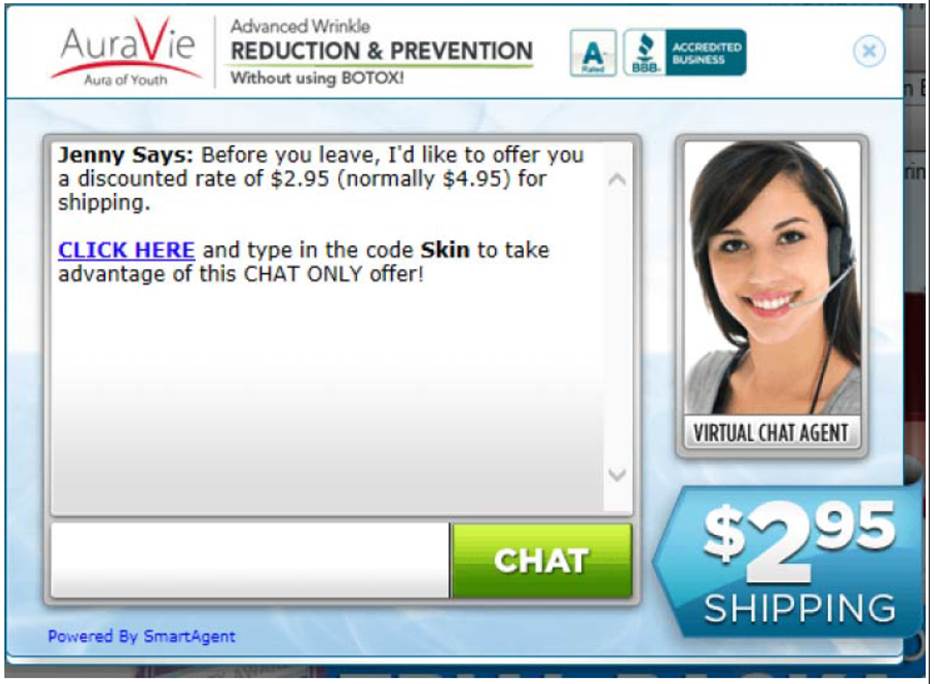

Ads promoting the risk-free trial of AuraVie, Dellure, LéOR Skincare, or Miracle Face Kit appear just about everywhere online, including on banners, pop-ups, and the defendants’ webpages.  What’s more, the FTC says the defendants buy ad space that appears on sites like Amazon.com, Huffingtonpost.com, and Lowes.com to push their promotions. Consumers are told all they have to do is give their credit or debit card number to cover the $5 shipping for the “100% satisfaction guaranteed” offer.

What’s more, the FTC says the defendants buy ad space that appears on sites like Amazon.com, Huffingtonpost.com, and Lowes.com to push their promotions. Consumers are told all they have to do is give their credit or debit card number to cover the $5 shipping for the “100% satisfaction guaranteed” offer.

The defendants don’t like taking no for an answer. If people try to leave the sites, they’re served pop-ups that pitch the risk-free trial at an even lower shipping cost. To seal the deal, a lot of ads feature that supposed A- rating from the BBB.

But according to the complaint, once consumers get their credit card or bank statements, they’re in for a shock. People who don’t return the product within 10 days are charged a hefty fee – as much as $97 – under terms buried in fine print on the defendants’ sites.

But according to the complaint, once consumers get their credit card or bank statements, they’re in for a shock. People who don’t return the product within 10 days are charged a hefty fee – as much as $97 – under terms buried in fine print on the defendants’ sites.

And it doesn’t end there. The FTC says the defendants enroll consumers without their permission in subscription plans that keep boxes piling up on their doorsteps – and charges piling up on their cards – until they cancel their memberships. No mean feat because according to the lawsuit, it's challenging for consumers to stop future shipments or get a refund.

Surprising conduct from a BBB-accredited company with an A- rating? Maybe. But not so surprising from an unaccredited business that earned a bottom-of-the-barrel rating of F. In other words, the defendants also didn’t tell the truth about their BBB rating.

The Court has issued a temporary restraining order, freezing the defendants’ assets and appointing a receiver. But even at this preliminary stage, the law enforcement action yields some notable compliance nuggets.

- The complaint alleges that the defendants contract with affiliate marketers, who in turn use banners, pop-ups, sponsored search terms and other methods to drive traffic to defendants’ sites. This shouldn’t be news to observant entrepreneurs. In recent years, the FTC has taken action against deceptive practices at every link of the affiliate chain.

- It’s an unfair practice under the FTC Act to have charges placed on consumers’ credit or debit cards without their express informed consent. In addition, under the Electronic Fund Transfer Act and Reg E, the kind of recurring charges the defendants impose has to be authorized in writing, with a copy “provided to the consumer when made.” Simply put, monkeying with people’s plastic is a bad idea all around.

- If you or your clients sell online, ROSCA should be on your compliance roster. The Restore Online Shoppers’ Confidence Act bans online negative options unless the seller clearly and conspicuously discloses all materials terms of the deal before getting a consumer’s billing information, gets the consumer’s express informed consent before making the charge, and provides a simple mechanism for stopping recurring charges. The FTC says the defendants’ unapproved recurring charges violate Section 5 of the FTC Act and ROSCA.

- For many consumers, accreditation from groups like the Better Business Bureau carries substantial weight. Like any other misrepresentation, deceptive claims about third-party ratings may be actionable under the FTC Act.