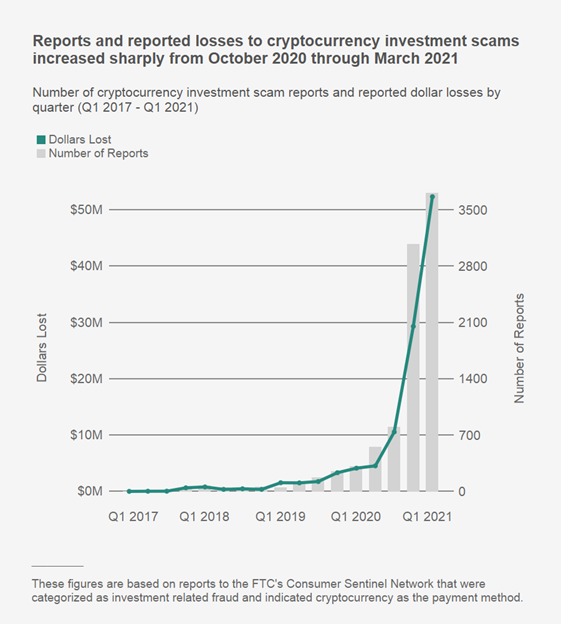

Investing in cryptocurrency means taking on risks, but getting scammed shouldn’t be one of them. Reports to the FTC’s Consumer Sentinel1 suggest scammers are cashing in on the buzz around cryptocurrency and luring people into bogus investment opportunities in record numbers. Since October 2020, reports have skyrocketed, with nearly 7,000 people reporting losses of more than $80 million on these scams.2 Their reported median loss? $1,900. Compared to the same period a year earlier, that’s about twelve times the number of reports and nearly 1,000% more in reported losses.3

Some say there’s a Wild West vibe to the crypto culture, and an element of mystery too. Cryptocurrency enthusiasts congregate online to chat about their shared passion. And with bitcoin’s value soaring in recent months, new investors may be eager to get in on the action. All of this plays right into the hands of scammers. They blend into the scene with claims that can seem plausible because cryptocurrency is unknown territory for many people. Online, people may appear to be friendly and willing to share their “tips.” But that can also be part of the ruse to get people to invest in their scheme. In fact, some of these schemes are based on referral chains, and work by bringing in people who then recruit new “investors.”

to get in on the action. All of this plays right into the hands of scammers. They blend into the scene with claims that can seem plausible because cryptocurrency is unknown territory for many people. Online, people may appear to be friendly and willing to share their “tips.” But that can also be part of the ruse to get people to invest in their scheme. In fact, some of these schemes are based on referral chains, and work by bringing in people who then recruit new “investors.”

Many people have reported being lured to websites that look like opportunities for investing in or mining cryptocurrencies, but are bogus. They often offer several investment tiers – the more you put in, the bigger the supposed return. Sites use fake testimonials and cryptocurrency jargon to appear credible, but promises of enormous, guaranteed returns are simply lies. These websites may even make it look like your investment is growing. But people report that, when they try to withdraw supposed profits, they are told to send even more crypto – and end up getting nothing back.

Then, there are “giveaway scams,” supposedly sponsored by celebrities or other known figures in the cryptocurrency space, that promise to immediately multiply the cryptocurrency you send. But, people report that they discovered later that they’d simply sent their crypto directly to a scammer’s wallet. For example, people have reported sending more than $2 million in cryptocurrency to Elon Musk impersonators over just the past six months.

Scammers even use online dating to draw people into cryptocurrency investment scams. Many people have reported believing they were in a long-distance relationship when their new love started chatting about a hot cryptocurrency opportunity, which they then acted on. About 20% of the money people reported losing through romance scams since October 2020 was sent in cryptocurrency, and many of these reports were from people who said they thought they were investing.4

Since October 2020, people ages 20 to 49 were over five times more likely to report losing money on cryptocurrency investment scams than older age groups.5 The numbers are especially striking for people in their 20s and 30s: this group reported losing far more money on investment scams than on any other type of fraud,6 and more than half of their reported investment scam losses were in cryptocurrency.7 In contrast, people 50 and older were far less likely to report losing money on cryptocurrency investment scams. But when this group did lose money on these scams, their reported individual losses were higher, with a median reported loss of $3,250.

To be clear, while investment scams top the list as the most lucrative way to obtain cryptocurrency, scammers will use whatever story works to get people to send crypto. That often involves impersonating a government authority or a well-known business. For example, many people have told the FTC they loaded cash into Bitcoin ATM machines to pay imposters claiming to be from the Social Security Administration. Others reported losing money to scammers posing as Coinbase, a well-known cryptocurrency exchange. In fact, 14% of reported losses to imposters of all types are now in cryptocurrency.8

Here are some things to know to play it safe(er) when it comes to cryptocurrency:

- Promises of guaranteed huge returns or claims that your cryptocurrency will be multiplied are always scams.

- The cryptocurrency itself is the investment. You make money if you’re lucky enough to sell it for more than you paid. Period. Don’t trust people who say they know a better way.

- If a caller, love interest, organization, or anyone else insists on cryptocurrency, you can bet it’s a scam.

To learn more about cryptocurrency scams, visit ftc.gov/cryptocurrency. If you spot a scam, report it to the FTC at ReportFraud.ftc.gov.

1 This Spotlight is based on reports from consumers to the FTC or to any Consumer Sentinel Network data contributor.

2 This figure is based on 6,792 cryptocurrency investment scam reports submitted from October 1, 2020 through March 31, 2021. Cryptocurrency investment scam reports here and throughout this Spotlight are defined as reports categorized as investment related fraud that indicate cryptocurrency as the payment method. The investment related fraud category includes the following fraud subcategories: art, gems and rare coin investments, investment seminars and advice, stocks and commodity futures trading, and miscellaneous investments. About 92% of cryptocurrency investment scam reports from October 1, 2020 through March 31, 2021 are classified as miscellaneous investments.

3 From October 1 2019 through March 31, 2020, people submitted 570 cryptocurrency investment scam reports indicating $7.5 million in total losses.

4 This figure is based reports submitted from October 1, 2020 through March 31, 2021 that were classified as romance scams. Reports that did not specify a payment method are excluded. Of these, 1,147 reports totaling $35 million in reported losses indicated cryptocurrency as the payment method. These reports are distinct from reports classified as investment related fraud, with no overlap between the two.

5 About 86% of cryptocurrency investment related fraud reports submitted from October 1, 2020 through March 31, 2021 included age information. This age comparison is normalized based on the number of loss reports per million population by age during this period. Population numbers were obtained from the U.S. Census Bureau Annual Estimates of the Resident Population for Selected Age Groups by Sex for the United States (June 2020).

6 This ranking is based on a comparison of Sentinel fraud subcategories. From October 1, 2020 through March 31, 2021, consumers ages 20-39 reported $114 million in total losses on frauds classified as miscellaneous investments. Excluding unspecified reports, the subcategory with second highest reported losses by this age group was online shopping with $64 million in reported losses. These figures are not limited to reports indicating cryptocurrency as the payment method.

7 This figure is based on reports submitted from October 1, 2020 through March 31, 2021 that were categorized as investment related fraud and indicated a consumer age of range of 20 to 39. Reports that did not specify a payment method are excluded. Of these, 3,581 reports totaling $35 million in reported losses indicated cryptocurrency as the payment method.

8 This figure is based on reports from October 1, 2020 through March 31, 2021 that were categorized as imposter scams. Reports that did not specify a payment method are excluded. Of these, 3,494 reports totaling $64 million in reported losses indicated cryptocurrency as the payment method. The imposter scams category includes the following fraud subcategories: business imposters, family and friend imposters, government imposters, romance scams, and tech support scams.