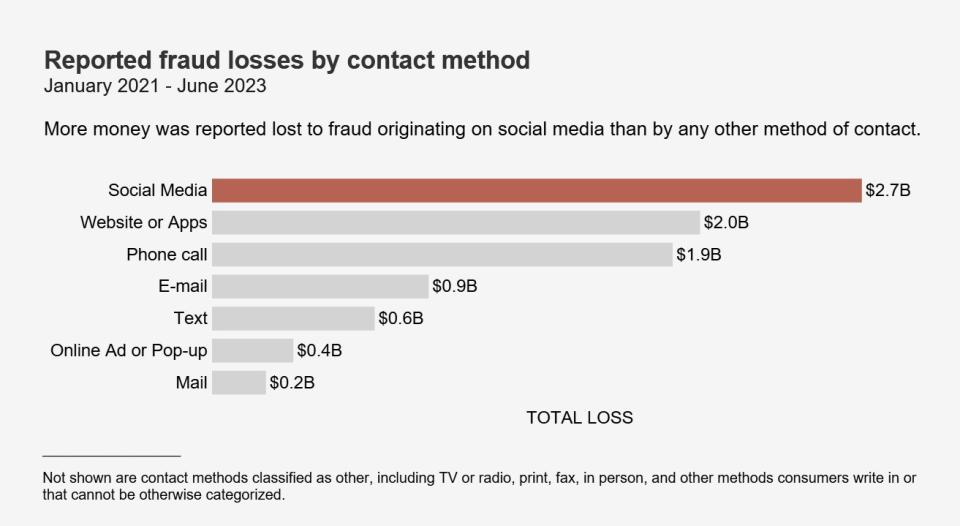

Scammers are hiding in plain sight on social media platforms and reports to the FTC’s Consumer Sentinel Network point to huge profits. One in four people who reported losing money to fraud since 2021 said it started on social media.[1] Reported losses to scams on social media during the same period hit a staggering $2.7 billion, far higher than any other method of contact. And because the vast majority of frauds are not reported, this figure reflects just a small fraction of the public harm.[2]

Social media gives scammers an edge in several ways. They can easily manufacture a fake persona, or hack into your profile, pretend to be you, and con your friends. They can learn to tailor their approach from what you share on social media. And scammers who place ads can even use tools available to advertisers to methodically target you based on personal details, such as your age, interests, or past purchases. All of this costs them next to nothing to reach billions of people from anywhere in the world.

Reports show that scams on social media are a problem for people of all ages, but the numbers are most striking for younger people. In the first six months of 2023, in reports of money lost to fraud by people 20-29, social media was the contact method more than 38% of the time. For people 18-19, that figure was 47%.[3] The numbers decrease with age, consistent with generational differences in social media use.[4]

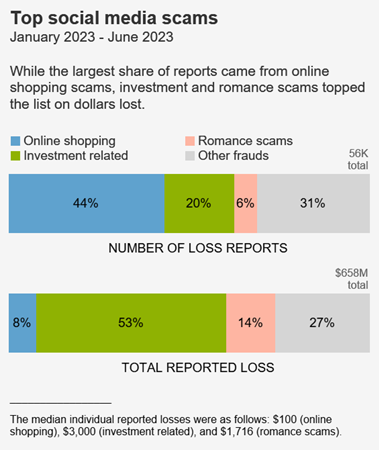

The most frequently reported fraud loss in the first half of 2023 was from people who tried to buy something marketed on social media, coming in at a whopping 44% of all social media fraud loss reports. Most of these reports are about undelivered goods, with no-show clothing and electronics topping the list.[5]According to reports, these scams most often start with an ad on Facebook or Instagram.[6]

While online shopping scams have the highest number of reports, the largest share of dollar losses are to scams that use social media to promote fake investment opportunities.[7] In the first six months of 2023, more than half the money reported lost to fraud on social media went to investment scammers. To draw people in, these scammers promote their own supposed investment success, often trying to lure people to investment websites and apps that turn out to be bogus. They make promises of huge returns, and even make it look like an “investment” is growing. But if people invest, and reports say it’s usually in cryptocurrency,[8] they end up empty handed.

After investment scams, reports point to romance scams as having the second highest losses on social media. In the first six months of 2023, half of people who said they lost money to an online romance scam said it began on Facebook, Instagram, or Snapchat.[9] These scams often start with a seemingly innocent friend request from a stranger followed by love bombing and the inevitable request for money.

Here are some ways to steer clear of scams on social media:

- Limit who can see your posts and information on social media. All platforms collect information about you from your activities on social media, but visit your privacy settings to set some restrictions.

- If you get a message from a friend about an opportunity or an urgent need for money, call them. Their account may have been hacked—especially if they ask you to pay by cryptocurrency, gift card, or wire transfer. That’s how scammers ask you to pay.

- If someone appears on your social media and rushes you to start a friendship or romance, slow down. Read about romance scams. And never send money to someone you haven’t met in person.

- Before you buy, check out the company. Search online for its name plus “scam” or “complaint.”

[1] This figure excludes reports that did not specify a contact method. Including reports directly to the FTC and reports provided by Sentinel data contributors, 257,945 reports about money lost to fraud originating on social media were filed from January 2021 through June 2023.

[2] See Anderson, K. B., To Whom Do Victims of Mass-Market Consumer Fraud Complain? at 1 (May 2021), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3852323 (study showed only 4.8% of people who experienced mass-market consumer fraud complained to a Better Business Bureau or a government entity).

[3] These figures exclude reports that did not specify a contact method and reports that did not include age information.

[4] See Pew Research Center, Social Media Use in 2021 (April 2021), available at https://www.pewresearch.org/internet/2021/04/07/social-media-use-in-2021/ (study showed people ages 18-29 reported the highest social media use at 84%, followed by ages 30-49 at 81%, ages 50-64 at 73% and 65 and over at 45%). In the first 6 months of 2023, the share of loss reports indicating social media as the contact method by age was as follows: 47% (18-19), 38% (20-29), 32% (30-39), 28% (40-49), 26% (50-59), 21% (60-69), 15% (70-79), 9% (80 and over). Social media was the top contact method ranked by fraud loss reports for all age groups under age 70, while phone call was the top contact method for the 70-79 and 80 and over age groups.

[5] The top undelivered items were identified by hand-coding a random sample of 400 reports that contained a narrative description identifying the items ordered.

[6] In the first 6 months of 2023, people reported undelivered merchandise in 61% of loss reports about online shopping fraud originating on social media. Facebook was identified as the social media platform in 60% of these reports, and Instagram was identified in 24%. This excludes reports that did not identify a platform.

[7] The top platforms identified in these reports were Instagram (30%), Facebook (26%), WhatsApp (13%), and Telegram (9%). Reports that did not indicate a platform are excluded from these calculations.

[8] In the first 6 months of 2023, cryptocurrency was identified as the payment method in 53% of investment-related fraud reports that indicated social media as the method of contact. This excludes reports that did not specify a payment method.

[9] Facebook and Instagram were each identified in 21% of these reports, followed by Snapchat at 8%. This excludes reports that did not specify the platform, website, or app.