Ask someone to picture the typical person who has experienced a scam and they may think of an older consumer taken in by a fast-talking fraudster. Regardless of the image they create, the results of the FTC’s latest Consumer Protection Data Spotlight suggest their impression may not be accurate. That’s because reports in the FTC’s Consumer Sentinel contradict some stereotypes about how fraud affects our communities and evoke a more nuanced picture. Here are some of the surprising findings revealed in the Data Spotlight.

- Who’s losing money to fraud – and how much are they losing? In 2021, Gen Xers, Millennials, and Gen Z young adults – people between 18 and 59 – were 34% more likely than people 60 and over to report losing money to fraud. The median individual fraud loss reported by people in the 18-59 age group was $500. But the Data Spotlight also suggests that when older adults lose money due to fraud, they’re hit harder in the wallet. People between 70 and 79 reported median individual losses of $800. For those 80 and over, that number shot up to $1,500.

-

Image

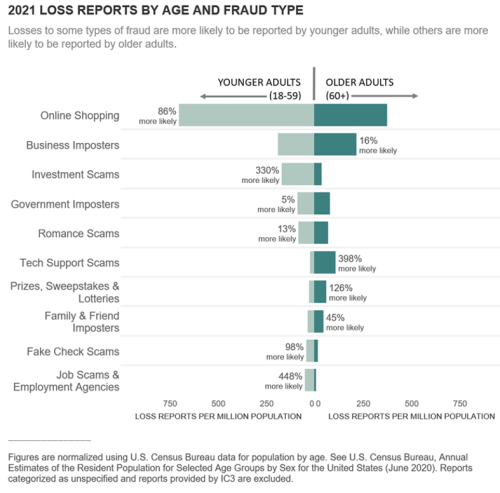

Are there differences in the types of fraud different generations report? People of every generation report all types of fraud, but there are big age differences in the likelihood of reporting some frauds. Compared with the over-60 sector, younger adults were 86% more likely to report losses to online shopping fraud, often in transactions that began with ads in social media. Younger adults were over four times more likely than older adults to report a loss due to an investment scam. Most of these were bogus cryptocurrency investment “opportunities.” But older consumers were about five times more likely to report losing money on tech support scams. They were also more than twice as likely to report losing money on a prize, sweepstakes, or lottery scam. According to reports, those scams are especially costly to people 80 and over. $47 million of the $151 million that age group reported as fraud losses were due to those scams.

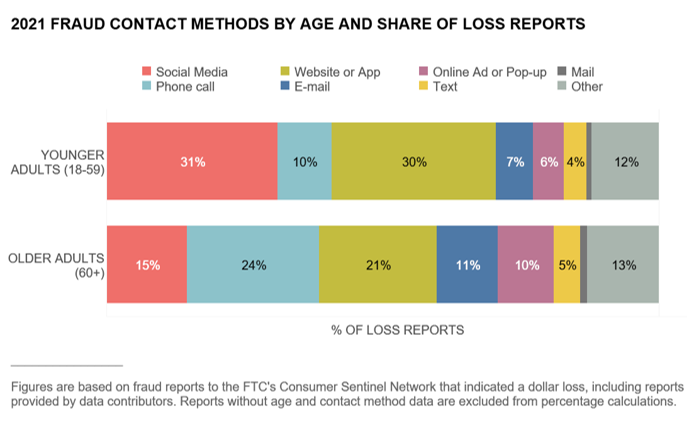

- How do scammers reach people? Not surprisingly, the reports reflect a generation gap based on preferred methods of communication. For the 18-59 age group, about 31% of the initial contacts were through social media and about 30% via text. For consumers 60 and above, social media accounted for 15% of initial contacts with texts at 21%. Phone calls were the initial contact for 24% of reports from those 60 and over. The numbers are higher still for people 80+ with more than 40% of their 2021 reported losses attributed to telephone contacts. That compares to just 10% for the 18-59 group.

The latest Consumer Protection Data Spotlight is consistent with many of the reported findings in the FTC’s recent Protecting Older Consumers Report. One interesting fact in the Data Spotlight is that older adults were 68% more likely than younger age groups to report fraud they had spotted, but didn’t lose money to. By relating their experiences at ReportFraud.ftc.gov, they help the FTC and other agencies in their law enforcement efforts. The bottom line: Older consumers – and people of any age – can help protect their community by sharing their experience and savvy. The FTC’s Pass It On materials make it easier to alert friends, family, and colleagues about prevalent forms of fraud.

Good job educating. What are you doing to nail these people? Frank

Wow...this is surprising. Thank you for this information!

To the ftc.gov webmaster, Your posts are always thought-provoking and inspiring.

Hello ftc.gov admin, You always provide in-depth analysis and understanding.

Hi ftc.gov administrator, Keep up the good work!