When consumers dispute the validity of a credit card charge, merchants may hire a “chargeback mitigation company” to dispute the consumer’s dispute. That’s the business of a company called Chargebacks911 – and the FTC and the Florida Attorney General have gone to court alleging the company is unfairly thwarting consumers’ efforts to challenge what consumers believe to be charges stemming from fraud, illegal business practices, or other questionable conduct.

First, a refresher on the chargeback process. Say a consumer believes a charge on their credit card implicates fraud or an unfair practice – or maybe a merchant has failed to come through with a refund or is making the person jump through hoops to get their money back. The consumer may dispute the charge with the “issuing bank” (the bank that issued their credit card) which then credits the consumer’s account and notifies the merchant’s “acquiring bank” of the chargeback. The merchant can then dispute the chargeback by filing documentation – a “representment” – to support their position that the charge is valid.

If the issuing bank agrees the charge is valid, it will debit the consumer’s account for the disputed amount. But if the issuing bank decides the charge isn’t valid, it will move to recover the chargeback from the acquiring bank and the acquiring bank, in turn, will collect the chargeback from the merchant. For any credit card transaction – but especially for online purchases – the chargeback process offers an important protection for consumers.

Excessive chargebacks can be a key indicator that a merchant is engaged in illegal practices. The credit card networks set thresholds for excessive chargebacks, and merchants with a high chargeback rate may be subject to additional scrutiny, penalties, or even termination by the networks.

In selling its services to merchants, Chargebacks911 has made a persuasive pitch: “We don’t just claim to be experts in chargeback reduction or dispute resolution: we spent years as successful online merchants ourselves, only to watch as chargebacks relentlessly chipped away at our profitability.” After “honing the solution on our own business, we decided to share our wealth of knowledge and expertise with fellow merchants.” A notable chunk of Chargebacks911’s clients have been online merchants that use negative option “free trial” marketing to promote their merchandise – often nutritional supplements or skin care products. What else do they have in common? For companies like Apex Capital, F9 Advertising, and AH Media, they’re Chargebacks911 clients that have been sued by the FTC for using unfair or deceptive negative option tactics.

Challenging consumers’ disputes has been big business for Chargebacks911. According to the FTC and Florida AG, the company took issue with more than 47,000 chargebacks for Apex Capital, more than 41,000 for F9 Advertising, and more than 77,000 for AH Media and affiliate Zanelo, LLC.

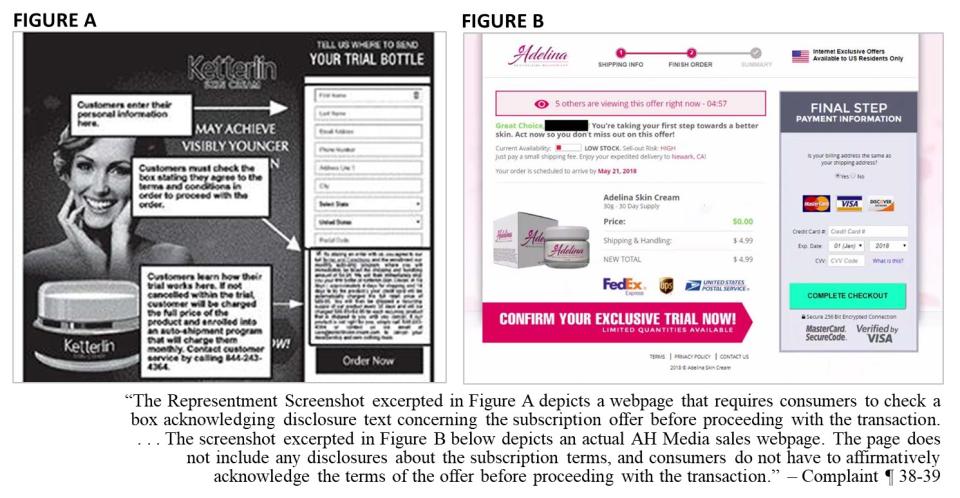

You’ll want to read the complaint for details, but the FTC and AG allege the defendants – Florida-based Global E-Trading (doing business as Chargebacks911), CEO Gary Cardone, and COO Monica Eaton – have used a variety of unfair tactics to defeat chargeback attempts by consumers slammed with fraudulent charges. For example, as part of representments filed on their merchant clients’ behalf, Chargebacks911 has sent screenshots to credit card companies that supposedly showed that consumers had agreed to the disputed charges. But according to the complaint, in many instances, those screenshots weren’t from the website where the consumer made the disputed purchase. The lawsuit also alleges that Chargebacks911 has ignored red flags that the screenshots it submitted to banks were not from the same websites that consumers visited to make the disputed purchase. What’s more, the FTC and Florida AG say that in some cases, Chargebacks911 has affirmatively edited screenshots to add disclosures that didn’t really appear on the webpages.

According to the complaint, from 2013 to 2019, the defendants used another tactic to create a misleadingly rosy picture of their clients’ business practices. In determining a company’s chargeback rate, credit card networks typically look at the number of chargebacks as a percentage of total transactions. The lawsuit alleges the defendants ran a number of small-value “microtransactions” through clients’ merchant accounts using prepaid gift cards. Rather than bona fide sales, the FTC and Florida say these were sham transactions designed to falsely boost the total number of transactions and thereby artificially reduce the merchant’s chargeback rate in an effort to evade or delay scrutiny from banks and credit card companies.

The complaint, which is pending in federal court in Tampa, alleges the defendants unfairly injured consumers by submitting misleading chargeback documentation and by running its microtransactions service, in violation of the FTC Act and the Florida Deceptive and Unfair Trade Practices Act. The FTC and AG have asked the court to stop the defendants’ illegal activities and order monetary relief.

Even at this early stage, the filing of the case offers some key takeaways for business:

- It’s against the law to engage in the kind of deceptive conduct that often leads to chargebacks in the first place. But it’s also illegal to use unfair and deceptive tactics – either on your own behalf or as a chargeback mitigation company – to thwart consumers trying to dispute invalid credit card charges.

- Decades of federal and state law enforcement against companies that use misleading negative options and bogus “free trials” should deter others from doing business with them or for them.

- The scope of the FTC Act and state consumer protection statutes is broad. Depending on the facts, companies whose conduct results in consumer injury could be held legally responsible, even when they don’t directly engage with the injured consumers.

This is a terrific case -- thank you, FTC!

And if your company receives enough chargebacks that you need "chargeback mediation" services, take a hard look at your business practices and figure out why so many of your customers are aggrieved.