In the TV show Star Trek: Voyager, Captain Janeway and crew headed to Delta Quadrant to take on wrongdoers that injured people by wielding a pernicious energy wave. In a twist on the story, the FTC has announced a proposed settlement with a cryptocurrency outfit called Voyager that injured people by wielding false claims that their accounts were “FDIC insured.” The agency is heading to court against Stephen Ehrlich, Voyager Digital’s CEO and founder.

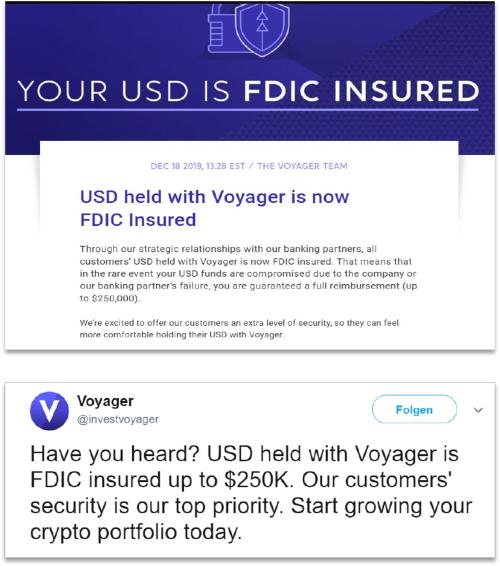

According to the FTC, Voyager enticed consumers to “ditch their bank” and hand over their cash and crypto with the express promises that their assets were “safe” with Voyager because they were “FDIC insured.” As the company claimed on its website, “Through our strategic relationships with our banking partners, all customers’ USD held with Voyager is now FDIC insured. That means in the rare event that your USD funds are compromised due to the company or our banking partner’s failure, you are guaranteed a full reimbursement (up to $250,000). We’re excited to offer our customers an extra level of security, so they can feel more comfortable holding their USD with Voyager.” The company further conveyed those claims through social media. As one post from the company put it, “Have you heard? USD held with Voyager is FDIC insured up to $250K. Our customers’ security is our top priority.”

The FTC says Voyager doubled down on those representations in correspondence with consumers. According to one email, the company stated, “What does it mean to be FDIC insured on Voyager? Great question. Your US dollars held on Voyager are insured up to $250,000 by our banking partner, Metropolitan Commercial Bank, so your cash is safe with us.” Another email reassured consumers that “the cash you hold with Voyager is protected up to $250,000 – which means it’s as safe with us as at a bank.”

According to the complaint, defendant Ehrlich reinforced those promises in a June 14, 2022, letter to consumers that described Voyager as “well-capitalized and positioned to weather the bear market.” Claiming that consumers’ deposits with Voyager were “FDIC insured,” Ehrlich said that “The cash you hold with Voyager is protected up to $250,000 – which means it’s as safe with us as at a bank.”

Except that it wasn’t, as consumers learned just a few weeks later when Voyager declared bankruptcy. As the complaint charges: “In fact, Voyager is not and has never been an FDIC-insured institution. The FDIC insures only deposits held by insured banks or savings associations. Voyager is not a chartered bank or savings association. FDIC insurance does not extend to crypto assets, such as the USD Coin stored on Voyager’s platform. Nor did FDIC insurance protect consumers’ U.S. dollar deposits against Voyager’s failure.”

The upshot of Voyager’s alleged deception: Consumer were locked out of their accounts for more than a month and lost more than $1 billion in crypto assets.

According to the complaint, the defendants violated the FTC Act by falsely claiming that consumers’ deposits were FDIC insured. What’s more, the FTC alleged they violated the Gramm-Leach-Bliley Act by using false statements to get customers’ financial information – in this case, their bank account numbers, routing numbers, and cryptocurrency wallet addresses.

To settle the case, Voyager and its corporate affiliates have agreed to a proposed order that imposes a $1.65 billion judgment, which will be suspended so Voyager can return its remaining assets to consumers in the bankruptcy proceedings. In a far-reaching provision to protect consumers in the future, the proposed order bans the companies from offering, marketing, or promoting any product or service that could be used to deposit, exchange, invest, or withdraw any assets. For how long? Forever. The law enforcement action against CEO Ehrlich is pending in a New York federal court.

The settlement with the Voyager corporate defendants sends compliance messages that should resound within the crypto industry. Not into crypto? Not so fast. The messages from the proposed settlement extend to pretty much any company that handles consumers funds or deposits.

Don’t claim that assets are insured or protected unless they really are. Before turning over assets to anyone in the financial sector, a key consideration for consumers is the safety and security of their savings. The complaint is replete with statements from customers about how influential Voyager’s “FDIC insured” claims were to their decision to do business with the company. Whether it’s a false statement that deposits are “FDIC insured” or any other misrepresentation about the safety or security of people’s accounts, companies that make deceptive claims of that nature can find themselves in legal hot water.

Heed warnings that your claims are problematic. According to the complaint, the bank where Voyager deposited consumers’ funds contacted the company in 2021 with the concern that Voyager’s claims were “potentially misleading.” A bank representative went on to say that “a reasonable consumer could conclude that his [USD Coin] held with Voyager is FDIC-insured.” How does the FTC say Voyager responded? Aside from making some changes to its cardholder agreement, the company continued to make deceptive “FDIC insured” claims.

Do your practices violate the Gramm-Leach-Bliley Act? If you haven’t reviewed the GLB Act recently, now is the time. The law makes it illegal to “obtain or attempt to obtain . . . customer information of a financial institution relating to another person . . . by making a false, fictitious, or fraudulent statement or representation to a customer of a financial institution.” The complaint charges that the defendants violated that provision “by soliciting consumer deposits to the Voyager platform via representations to customers of financial institutions, directly or indirectly, expressly or by implication, that consumers’ funds held with Defendants are FDIC insured.”

The scope of individual liability under the FTC Act is expansive. “You can’t sue me individually. We’re incorporated!” The FTC hears that a lot, but it shows a fundamental misunderstanding of the law. In appropriate circumstances, the FTC may protect consumers by taking law enforcement action against executives that participate in or have the authority to control practices that harm consumers.