For small businesses struggling to stay afloat during COVID, time was of the essence. When help materialized in the form of the emergency Paycheck Protection Program (PPP) administered by the Small Business Administration, businesses owners knew they had to move fast to apply for first-come-first-served funds necessary to keep their doors open and their people employed. A proposed record-setting $33 million damages settlement with Biz2Credit, Inc., alleges that the small business lender promised to process PPP loan applications quickly, but instead left many small businesses in the lurch by delaying the process and setting up roadblocks that prevented them from applying through other lenders.

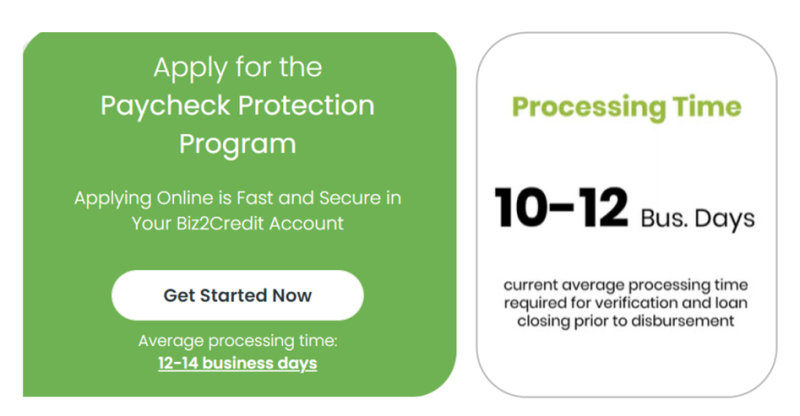

When the SBA authorized a number of lenders to submit PPP applications on behalf of small businesses, Biz2Credit moved quickly into that line of work. According to the complaint – which also names Itria Ventures, LLC – the defendants lured consumers in with ads promising to process their applications within an average time frame “10-12 business days” or, in some instances, “12-14 business days.” But the FTC says that the defendants’ application processing was “riddled with delays,” resulting in tens of thousands of consumers waiting over two months for a final determination.

The complaint outlines the consequences of the defendants’ allegedly illegal conduct. First, for some small business owners struggling for emergency funds during the worst days of COVID, the promise of fast processing was essential to their ability to survive. As one consumer described the impact of the defendants’ alleged misrepresentations:

Biz2Credit approved a . . . PPP loan for my restaurant back in February [2021]. As of today [May 6], we are still waiting for funds to be deposited into our bank account. . . . We are in desperate need of these funds. . . . The last time we heard from the[m] was [March 31]. Since then all of our messages have gone unanswered.

According to the complaint, the defendants continued to make their “10-12 business days” or “12-14 business days” claims even when they knew they weren’t honoring those promises.

Furthermore, once a consumer applied for a PPP loan through a company like Biz2Credit and the SBA had issued what was called an e-tran number, the person wasn’t allowed to apply though another lender unless the first lender withdrew the consumer’s application. According to the FTC, “Defendants designed their application process to lock in as many consumers as possible and to block those consumers from applying to other lenders. They did so by rapidly accepting hundreds of thousands of applications and immediately obtaining SBA e-tran numbers for those applications before engaging in any real underwriting.” One of the consumers who contacted the defendants explained the impact of this COVID Catch-22:

I applied for a PPP Loan with Biz2Credit on Feb 17, [2021]. . . . I received my SBA ETRAN number on Feb 18th and uploaded all of my required documentation . . .. From that point on I received ABSOLUTELY NO COMMUNICATION from this company. I have emailed on numerous occasions to different support emails. Called the company but no one answers, just says to email and then hangs up. . . . The[y] won’t fund my loan, and they are holding me hostage because they have my loan so I cannot fund with someone else.

Another consumer put it this way: “We have asked to withdraw this application so many times. It has been over a month, and we don’t understand why the loan is still active with SBA. …You are preventing us from getting the help that is crucial to our business.”

The FTC says that despite consumers’ desperate pleas, in numerous instances, the defendants didn’t let them withdraw their applications – a practice the FTC alleges was unfair. What’s more, given that the PPP was a temporary program that ended when funds ran out in mid-2021, some consumers subjected to these delays lost their opportunity to get PPP loans entirely.

The complaint charges the defendants with violating the FTC Act and the COVID-19 Consumer Protection Act. The proposed settlement prohibits a broad range of misrepresentations related to the extension of credit and includes a $33 million financial judgment, which the FTC will use for redress for small businesses harmed by the practices challenged in the complaint. Stay tuned for more information about potential payments from this settlement. Bookmark the case page and check back regularly for more information as it becomes available.

Companies in this sector should remember that established consumer protection principles apply when they advertise to small businesses. Another key takeaway from the case is the FTC’s ongoing commitment to protect small businesses from unlawful practices. Let’s look at what’s happened in just the past few weeks. On March 7th, the FTC amended the Telemarketing Sale Rule to cover misrepresentations made in telemarketing calls to businesses. And the $33 million proposed settlement with Biz2Credit was accompanied by the announcement of a proposed $26 million settlement with Womply – another company the FTC says deceived small business consumers about PPP loans. These actions emphasize the agency’s efforts on behalf of smaller companies.

Excellent article!

When will get rewarded for their misrepresentation of these two companies