Many people appreciate the flexibility of gig work. But if your company offers gig work opportunities, there’s one thing that isn’t flexible: your obligation to comply with established consumer protection laws, including the FTC Act and – where applicable – the Business Opportunity Rule. That’s a key takeaway from the FTC’s $7 million proposed settlement with Arise Virtual Solutions. The case also serves as a compliance reminder to the more than 1,100 companies – including Arise – that received the FTC’s Notice of Penalty Offenses Concerning Money-Making Opportunities that violations can prove costly.

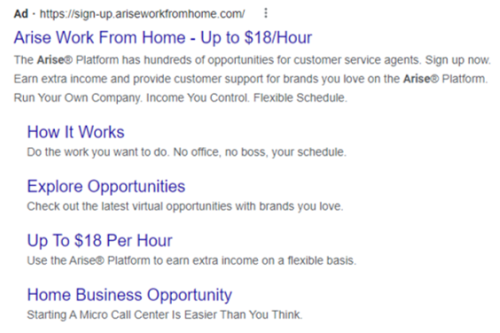

According to the complaint, Florida-based Arise Virtual Solution claimed that its platform “provides an unparalleled business opportunity for tens of thousands of stay-at-home moms, veterans, college students, retirees, and other entrepreneurial-minded individuals.” One particularly persuasive hook was Arise’s representation that consumers would earn “up to $18/hour” by working as customer service agents for Fortune 500 companies.

Pitching its business opportunity as an alternative to full-time employment, Arise further enticed people with claims like “run your own company,” “be your own boss,” and “kiss your 9-to-5 goodbye.” For example, one ad featured a testimonial from a consumer who claimed, “Prior to starting my own call center, I worked two jobs, one full-time and the other part-time. In a matter of months I was able to quit both jobs and dedicate my time to my company. The Arise Platform has truly changed my life.”

But according to the FTC, Arise’s internal documents told an altogether different story. The FTC says that Arise made those “up to $18/hour” representations when the average pay for jobs on the its platform was just $12 an hour and that 99.9% of the consumers made less than the advertised $18 in hourly pay. Why would Arise continue making an “up to $18/hour” claim? Again, Arise’s internal documents may offer insights. According to the complaint, the company’s testing established that more consumers responded to its ads when they made specific dollar-amount earnings representations, as opposed to general references about extra income. What about claims that Arise was an alternative to full-time employment? The FTC alleges Arise typically didn’t provide income that could replace a full-time job or support a household.

The lawsuit alleges that misleading earnings claims weren’t the only way Arise injured consumers. Once Arise lured people in, the FTC says that’s when the company piled on additional fees people had to pay before starting. To meet Arise’s requirements, many consumers had to shell out for specific office equipment, high-speed internet access, and a background check. To work for some of Arise’s corporate clients, some people also needed to get a second monitor, hard-wired telephone service, or even a special computer sold and financed by Arise.

Until Arise received a Civil Investigative Demand from the FTC, the company also made consumers pay for mandatory training. The complaint alleges that on average, just 36.8% of consumers who enrolled in one of Arise’s training programs successfully completed it – and those who left generally couldn’t get their money back on what they had to spend up front. In addition, even consumers who jumped through all those hoops had to pay Arise nearly $40 a month in mandatory fees.

The complaint alleges Arise violated the FTC Act by making deceptive claims both about overall earnings and hourly earnings. In addition, the FTC says the company engaged in multiple violations of the Business Opportunity Rule, which – among other things – requires companies offering business opportunities to provide consumers with a Disclosure Document mandated by the Rule and to include specific disclosures in advertising. To settle the case, Arise will turn over $7 million, which the FTC will use to provide refunds for consumers. The proposed order also includes injunctive provisions that will change how Arise does business in the future.

What can other companies take from the FTC’s action against Arise?

The Business Opportunity Rule applies to certain gig work offers. You’ll want to read the FTC’s Business Opportunity Rule for the specifics, but the Rule applies when: 1) “A seller solicits a prospective purchaser to enter into a new business,” 2) “The prospective purchaser makes a required payment,” and 3) The seller represents that it will “provide outlets, accounts, or customers.” (According to the FTC, some of Arise’s mandatory fees are “required payments” under the Rule.) The Rule doesn’t necessarily apply to all gig work opportunities, but the FTC says Arise’s conduct put it squarely within the Rule’s coverage. To help protect consumers from deceptive earnings claims, the Rule is specific in what it requires. For example, sellers must provide consumers with a one-page Disclosure Document at least seven days before the consumer signs a contract or pays any money for the business opportunity. If sellers make earnings claims, they must give the consumer a separate document that says across the top EARNINGS CLAIM STATEMENT REQUIRED BY LAW. And sellers must make certain required disclosures in ads that run online, on TV, in newspapers, or in other media. Read Selling a Work-at-Home or Other Business Opportunity? Revised Rule May Apply to You for more information.

The FTC pays close attention to questionable business practices that target communities of color. Law enforcement is a key component of the FTC’s “Every Community” initiative, which strives to meet the needs of the diverse U.S. population by protecting all consumers from deceptive practices. The complaint against Arise alleges its gig workers are often people of color, with about 60% identifying themselves as Black, Latino, or multiracial. In addition, about 90% are women. Companies whose illegal conduct disproportionately injures members of communities of color – or other groups, including older consumers, veterans, or students – need to know the FTC will examine those practices very carefully. Read the FTC Staff Report, Serving Communities of Color, to learn more.

The FTC means business when it sends a business a Notice of Penalty Offenses. According to the complaint, Arise received a Notice of Penalty Offenses Concerning Money-Making Opportunities on April 27, 2022, and yet continued to make allegedly unsubstantiated earnings claims. If your company received that Notice of Penalty Offenses – or any of the other Notices the FTC has sent – review your practices to make sure you’re complying with the law.

Okey yes

So do we have to fill out anything to be paid from this law sue?

Will there be a payment made to those who worked for Arise?

Is there something we have to fill out . I worked for arise from 2019- 2022 and had several successful assignments and was never paid what they promised.

When do we follow up on any settlement? What do we need to do to be included? I have already created a case in regard to non payment and incorrect metrics.