Consumer protection enforcers have challenged bait-and-switch tactics for years. But a complaint filed by the FTC and the Arizona Attorney General against Tempe-based Coulter Motor Company and former General Manager Gregory Depaola alleges the defendants engaged in illegal conduct that could be more accurately described as bait, switch, hitch, and which? – in other words, deceptive advertising, hiked prices, unauthorized add-ons, and discriminatory practices targeting Latino consumers. The proposed settlement, which includes a $2.6 million financial judgment, is designed to replace those tactics with two other rhymed imperatives: abate, stop illegal conduct immediately, and elevate, raise your business practices now and in the future.

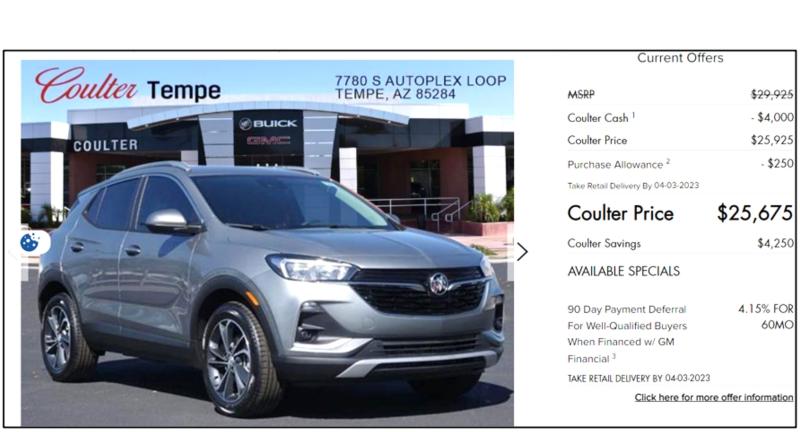

First, the bait. According to the complaint, the defendants advertised cars with eye-catching sale prices. For example, the defendants promoted a car on its website for the “Coulter Price” of $25,675 – $4,250 below the advertised MSRP. But when the defendants’ attention-grabbing prices lured consumers to their dealerships, that’s where the FTC and the Arizona AG say the switch started. As the lawsuit alleges, consumers spent considerable time in the negotiation and buying process with the understanding the defendants would sell or lease them the vehicle at the advertised price only to learn later that it would cost them hundreds or even thousands of dollars more. According to the complaint:

“Defendants’ advertisements on third-party websites do not mention the additional charges. And Defendants obscure any reference to these charges on their websites at the bottom of the page, only visible if consumers scroll, or behind small gray hyperlinks appended to its advertisements. Even if a consumer were to find this information, it does not indicate whether the listed charges are part of, or in addition to, the advertised price.”

The tactics the defendants allegedly used to try to explain away those major price hikes were where the hitch came in. The FTC and the Arizona AG say that in many instances, the defendants attempted to justify substantial price increases by citing a contrived “market adjustment.” As one consumer reported, the defendants used a purported “market shortage” as the reason for charging thousands of dollars more than the advertised price.

Another hitch the defendants threw into the buying process was allegedly inflating the ultimate cost of vehicles by deceptively and unfairly stacking up unauthorized add-ons – for example, theft protection, paint coating, window tint, Vehicle Identification Number etching, and nitrogen tires. The FTC and the Arizona AG say that in many instances, the defendants charged for add-ons the buyer never agreed to and instead buried them “in a mountain of paperwork.” One tactic alleged in the complaint is “packing” – getting a consumer to agree to a monthly payment higher than what they need to pay under the contract and then “packing” the contract with unwanted add-ons to make up the difference between the lower payment and the inflated offer.

If consumers noticed the add-ons and raised a concern, the lawsuit alleges the defendants often falsely claimed the add-ons were required. In other instances, the FTC and the Arizona AG say that customers were double-billed for the same add-on. For example, the defendants allegedly charged some consumers $696 for the “Coulter Value Package” and an additional $299 for VIN etching, although VIN etching was supposedly part of the “Coulter Value Package.”

How prevalent were these hitches involving add-ons? Here’s how the complaint quantifies it: “According to a survey of Coulter customers, 92% of them were charged for an add-on without authorization or because they thought it was required.”

Now for the which? allegation in the FTC-Arizona AG lawsuit. By that, we mean that how much the defendants charged consumers depended on which consumers were doing the buying. The complaint alleges that on average, Latino consumers who shopped at Coulter paid nearly $1,200 more in interest and add-on charges than their non-Latino White counterparts.

To understand what the FTC and Arizona AG allege was going on behind the scenes, it’s important to understand some fundamentals about auto financing. The defendants arrange financing through third-party companies. Each financing company gives the defendants a specific “buy rate,” a risk-based finance charge that reflects the interest rate at which the company will finance the deal. Some companies allow dealers to add a discretionary charge to the buy rate called a “markup.” Unlike the buy rate, the markup isn’t based on the underwriting risk or the credit characteristics of the individual applicant. As the complaint describes it, it’s “pure profit” for the dealerships and they compensate their sales staff with a percentage of the markup. In other words, the defendants set up a system that created a financial incentive for their sales staff to add interest rate markups to the total contract rate for certain consumers although those consumers would see only the final number.

The complaint alleges that since at least April 2019, the defendants have charged Latino consumers more in markups than similarly situated non-Latino consumers, resulting in hundreds of dollars more in finance charges, and roughly $800 more in add-ons. The FTC and the Arizona AG say that no legitimate, nondiscriminatory reasons existed for this discrepancy. What’s more, the defendants’ practice of giving their sales staff unfettered discretion to add interest rate markups and set the prices for add-ons allegedly led to these statistically significant disparities.

The six-count complaint charges the defendants with multiple violations of the FTC Act, the Equal Credit Opportunity Act, and the Arizona Consumer Fraud Act. To settle the case, the defendants will pay $2.35 million in consumer redress and a $250,000 civil penalty to Arizona. In addition to other provisions aimed at protecting future car shoppers, the proposed order bans non-beneficial add-ons, requires the defendants to get consumers’ express informed consent before charging for add-ons or other services, requires them to clearly disclose the offering price and key payment terms for vehicles in certain ads and communications, and implements a comprehensive fair lending program.

What’s the primary message of this action and other recent collaborative federal-state cases against dealers charged with illegal conduct? The FTC and state enforcers remain committed to protecting consumers from unfair, deceptive, or discriminatory sales and financing practices in the car buying process.

Now, it’s time to go after the trades people who engage in price fixing.

I would highly advise the Attorney General to look into Coulter Nissan of Surprise. They did a bait and switch on me and tacked on charges that we later questioned, to no avail. Please consider this. If one is doing it, they are likely all doing it. Coulter Nissan of Surprise are complete and total rip offs. Thank you.