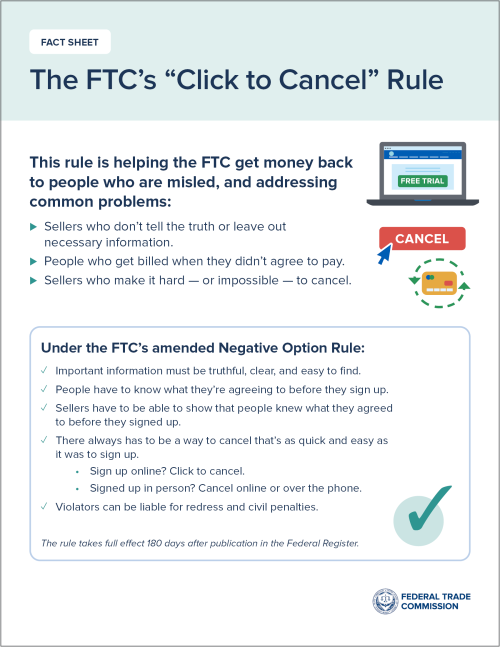

The FTC has long regulated negative options through the Negative Option Rule and strategic enforcement actions. Today, the FTC builds on that work by announcing a set of common-sense revisions to the Negative Option Rule, now known as the Rule Concerning Recurring Subscriptions and Other Negative Option Programs. The revisions are designed to protect people from misleading enrollment tactics, billing practices, and cancellation policies, and provide businesses with clear rules of the road, all consolidated in one place, to help them build customer trust and avoid enforcement action.

Most of the provisions of today’s final rule will go into effect in 180 days, with some in effect within 60 days after publication in the Federal Register. This marks the end of a multi-year process that began in 2019 and reflects input from thousands of public comments from consumers, industry, law enforcement partners, and others. The details are in the Federal Register Notice, but here are the main takeaways for businesses.

- The rule applies to almost all negative option marketing. The rule applies to negative option marketing, including prenotification and continuity plans, automatic renewals, and free trial offers, whether the offer appears online, on the phone, or in person. And, importantly, the rule covers business-to-business transactions, as well as business-to-consumer transactions. That means a few things for business owners. It means the rule applies to almost any negative option program you offer. And it also means if you enroll your business in a negative option program, your business gets the same protections as an individual consumer.

- Material misrepresentations are prohibited. The rule picks up on well-established truth-in-advertising principles. If you’re advertising a negative option, don’t mislead people about any important aspect of your offer, including the terms of your negative option program, the purpose or efficacy of the product or service you’re selling, or anything else likely to matter to your customers.

- Disclose all material terms of the deal before asking people to sign up. A material term is any part of your offer that would matter to the customer or influence their decision whether to sign up. For example, material terms might include how much and how frequently you’re going to charge people, when free trials or promotional offers will end, deadlines to withdraw from your program, and how to cancel. All this information should be clear, conspicuous, and available to your customers before they enroll. And certain key information related to charges and cancellation must appear right when and where the customer agrees to the negative option, every time.

- Obtain proof of consent before charging people. Being able to demonstrate your customers fully understood what they were signing up for before you started charging them protects your business and your customers. Don’t try to distract people with other information. Get proof of consent and maintain it for at least three years. Note that the rule gives you some flexibility on what that proof looks like. In many cases, a checkbox, signature, or similar method is just fine. For negative option offers made over the phone, make sure you’re also complying with the Telemarketing Sales Rule.

- Include a simple way for people to cancel (a/k/a “Click to Cancel”). Make it as easy for people to withdraw from your program as it was to sign up. That means people have to be able to find your cancellation method quickly and easily. It should be offered through the same medium (online, phone, etc.) people used to sign up, and it shouldn’t be overly burdensome. Keep these three guardrails in mind:

- You can’t require people to talk to a live or virtual representative to cancel if they didn’t have to do that to sign up.

- If you’re offering phone cancellation, you can’t charge extra for that service, and you have to answer the phone or take a message during normal business hours. If you take a message, you have to respond to people promptly.

- If people originally signed up for your program in person, you can offer them the opportunity to cancel in person if they want to, but you can’t require it. Instead, you need to offer a way for people to cancel online or on the phone.

- Other rules and laws may apply. The rule does not preempt state laws that require more protection for consumers. Take the time to research any state laws that may apply where you offer your product or service. If those laws impose requirements beyond the FTC’s rule, you must comply.

- Violators may be liable for civil penalties. Some provisions of the rule will start to go into effect within 60 days, with most parts in full effect within 180 days. Take this time to make sure you’re fully complying and avoid the possibility of civil penalties down the line.