You have to say this about scammers: They’re up on current events. As early as February 2020, con artists were already using the coronavirus as a hook for swindles and scams and the FTC was sounding an alert for consumers. It didn’t take long before scammers targeted businesses, too. Now that many companies are returning to an in-person workplace, some fraudsters will try to take advantage of the transition. As you get back to business, keep your guard up against these forms of B2B deception.

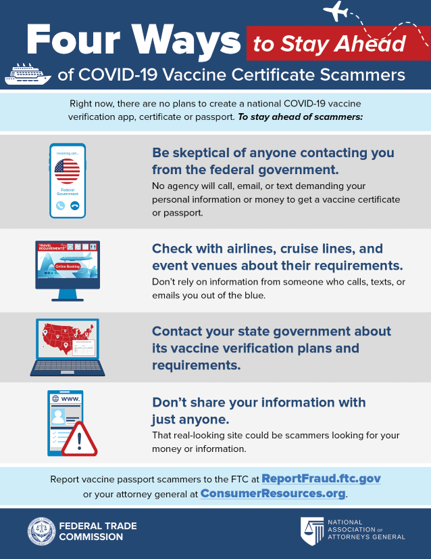

Spot the signs of an imposter scam. Since the beginning of the pandemic, the FTC has received reports of con artists using telemarketing, email, and even bogus apps to impersonate government employees or public health officials. Now we’re hearing about “vaccine certificate” scams. What’s the modus operandi? They contact businesses and consumers out of the blue with official-sounding – but false – information about so-called national vaccine certificates, “passports,” or “verification apps.” Their real purpose is to grab money or personal information. The FTC has tips on spotting this form of fraud and advice on strengthening your defenses against imposter scams.

Spot the signs of an imposter scam. Since the beginning of the pandemic, the FTC has received reports of con artists using telemarketing, email, and even bogus apps to impersonate government employees or public health officials. Now we’re hearing about “vaccine certificate” scams. What’s the modus operandi? They contact businesses and consumers out of the blue with official-sounding – but false – information about so-called national vaccine certificates, “passports,” or “verification apps.” Their real purpose is to grab money or personal information. The FTC has tips on spotting this form of fraud and advice on strengthening your defenses against imposter scams.

Stick with suppliers you know or who come recommended by people you trust. This time last year companies were scrambling for masks, disinfectants, and other essentials. When businesses ordered from unfamiliar websites that promised fast shipping of scarce products, they often found themselves with emply hands and empty wallets. As manufacturers gear up and offices reopen, some industries are reporting shortages of raw materials – conditions that are conducive for supply chain scams. The wiser course is to stick with suppliers who have proven to be reliable in the past or who come recommended by trustworthy colleagues.

Alert your staff to unemployment benefits fraud. Throughout the pandemic, the FTC has asked public-spirited businesses and consumers to contact us at ReportFraud.ftc.gov about suspicious practices you’ve spotted. Those reports cast a spotlight on phony unemployment benefits applications that crooks had filed using the names, dates of birth, and Social Security numbers of people who had not lost their jobs. It’s affected tens of thousands of people and has cost states hundreds of millions of dollars. What can you do? If an employee suspects their personal information has been compromised in this way, report it online to the appropriate state unemployment insurance office and suggest they visit identitytheft.gov for step-by-step guidance.

Next in the Back to Business series: Looking for small business financing?