Let’s call it The Recliner Interval – the time it takes for an obscure niche product to start running prime time TV commercials. It’s a made-up metric, of course, but a few hours in front of the TV will demonstrate that advertising for cryptocurrency has gone mainstream. Now here’s a metric that isn’t made up. According to the latest FTC Consumer Protection Data Spotlight, since the start of 2021, more than 46,000 people have reported losing over $1 billion in crypto to scams. That’s about one out of every four dollars reportedly lost to fraud during that period.

The Data Spotlight reveals that reported losses to crypto scams in 2021 were nearly 60 times what they were in 2018. Certain features of cryptocurrency may explain why it’s a pet payment method for crooks and cons. There’s no bank or other entity to flag suspicious transactions before they happen. Crypto transfers can’t be reversed. Once the money’s gone, you can kiss your crypto buh-bye. And most people are still unfamiliar with how crypto works. Those considerations aren’t unique to crypto, but they do offer insights into why it’s become a fraudster favorite.

Compounding the problem are the ways that social media and crypto can form – to quote the Data Spotlight – a “combustible combination.” Nearly half the people who reported losing crypto to a scam since 2021 said it started with an ad, post, or message on a social media platform. Of those who specified the platform where the scam began, 32% said it was on Instagram, 26% said Facebook, 9% said WhatsApp, and 7% said Telegram.

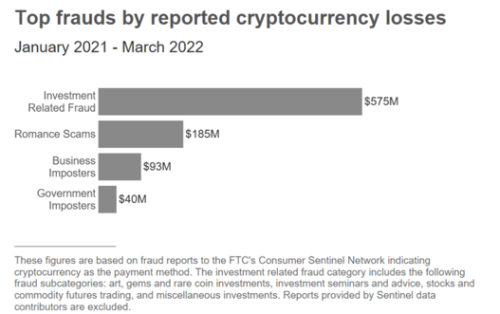

Since 2021, $575 million of the reported crypto fraud losses involved bogus investment opportunities. Investment scammers promise big returns, but then often use crypto smoke and mirrors to prey on people’s inexperience. For example, some people report that certain websites and apps claimed to track the growth of their crypto investment, but the impressive-sounding returns turned out to be fake. Others tell us that scammers won their confidence by allowing them to make a small “test” withdrawal, but when they try to cash out, they were told to send more crypto in “fees” and they don’t get any of their money back

The Data Spotlight describes other typical MOs used by con artists to get people to send crypto. Romance scams remain a favorite, as well as imposter scams. Those may start with a bogus text about a supposedly unauthorized purchase from a national name like Amazon. Scammers may even get a “bank” on the line to confirm the story, but it’s really just a partner in crime.

So who’s getting stung by crypto scams? According to the Data Spotlight, the 20-49 age group was more than three time more likely than older consumers to report losing cryptocurrency to a scammer. 30-somethings appear to be the hardest hit with 35% of their reported fraud losses since 2021 sent in crypto. But when it comes to individual losses, median reported losses for people in their 70s have been the highest at $11,708. This is consistent with trends we’ve seen from previous Data Spotlights: Older consumers may report a lower rate of fraud, but when they report financial loss, the dollar amounts are often higher.

What the Data Spotlight suggests is that even people who consider themselves tech-savvy can lose money to crypto crooks. Here are three things to bear in mind to protect yourself:

- Only scammers will guarantee profits or big returns.

- No one legitimate will insist that you buy cryptocurrency.

- If an online love asks you to send crypto – or claims they can show you how to make money investing in crypto – pull the plug on your virtual romance.

Looking for more information about crypto scams? Visit ftc.gov/cryptocurrency. Report deceptive practices to the FTC at ReportFraud.ftc.gov.

Crypto remains still a gray area in the world of investment.