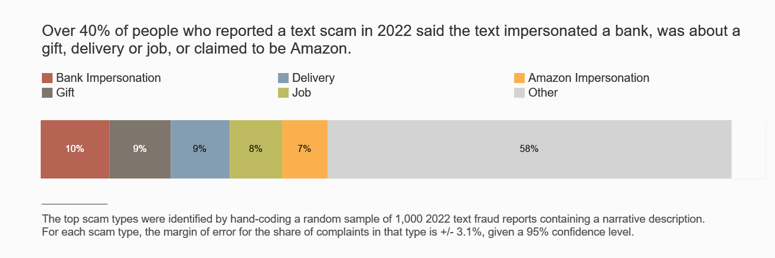

According to reports in the FTC’s Consumer Sentinel database, text message scams took consumers for $330 million in 2022. The latest Consumer Protection Data Spotlight focuses on this form of fraud. With reported losses more than doubling in 2021 and nearly five times what people reported in 2019, would you be able to spot the five most common text message scams? What about your employees?

First, some background about what may be behind the proliferation of this form of fraud. It’s estimated that text message open rates are as high as 98%, compared to email open rates of 20% – and they cost next to nothing to send. So people may have grown accustomed to responding to that ping with an automatic click. The growth of text scams should be of particular concern to businesses. Aside from the fact that your family and friends may be among the consumers who have reported median personal losses of $1,000, a lot of the messages take on a distinctly “office-y” tone that may target your staff – fake deliveries, bogus job offers, and the like. It should also concern businesses that scammers often do their dirty work by stealing the names of well-known companies, with 51% of reports of text fraud categorized in Consumer Sentinel as business imposters.

The Data Spotlight focuses on these five common text message scams.

1. Copycat bank fraud prevention alerts. According to the Data Spotlight, reports about texts impersonating banks are up nearly twentyfold since 2019 with median reported individual losses of $3,000 last year. People get a text supposedly from a bank asking them to call a number ASAP about suspicious activity or to reply YES or NO to verify whether a transaction was authorized. If they reply, they’ll get a call from a phony “fraud department” claiming they want to “help get your money back.” What they really want to do is make unauthorized transfers. What’s more, they may ask for personal information like Social Security numbers, setting people up for possible identity theft.

2. Bogus “gifts” that can cost you. What about those texts claiming to be from a well-known company offering a free gift or reward? If people click the link and use their credit card to cover the small “shipping fee,” they’ve just handed over their account information to a scammer. Reports to Consumer Sentinel tell us that fraudulent charges are likely to follow.

3. Fake package delivery problems. On any given day, what home or business isn’t expecting a delivery? Scammers understand how our shopping habits have changed and have updated their sleazy tactics accordingly. People may get a text pretending to be from the U.S. Postal Service, FedEx, or UPS claiming there’s a problem with a delivery. The text links to a convincing-looking – but utterly bogus – website that asks for a credit card number to cover a small “redelivery fee.”

4. Phony job offers. With workplaces in transition, some scammers are using texts to perpetrate old-school forms of fraud – for example, fake “mystery shopper” jobs or bogus money-making offers for driving around with cars wrapped in ads. Other texts target people who post their resumes on employment websites. They claim to offer jobs and even send job seekers checks, usually with instructions to send some of the money to a different address for materials, training, or the like. By the time the check bounces, the person’s money – and the phony “employer” – are long gone.

5) Not-really-from-Amazon security alerts. People may get what looks like a message from “Amazon,” asking to verify a big-ticket order they didn’t place. Concerned about the security of their account, people call the number in the text and are connected to a phony Amazon rep who offers to “fix” their account. But oopsie! Several zeroes are mistakenly added to the “refund” and the “operator” needs the caller to return the overpayment, often in the form of gift card PIN numbers.

According to the Data Spotlight, reporting can help stop scam text messages. Forward the text to 7726 (SPAM). This helps your wireless provider block similar messages. Report it on either the Apple iMessages app or Google’s Messages app for Android users. And report it to the FTC at ReportFraud.ftc.gov.

Here is additional advice for your employees:

- Don’t click on links or respond to unexpected texts. If you aren’t sure if a text legit, contact the company directly using a phone number or website you know is real – for example, the 24-hour toll-free number on the back of your credit or bank card. Don’t use the information in the text message.

- Filter unwanted texts before they reach you. The FTC has advice on blocking unwanted texts.

Can you add a "Print" link that formats this article in a pop-up window for easy printing?

In reply to Can you add a "Print" link… by Rich S.

@Rich,

To get a formatted copy of any Business Blog, type Control-P and you should see a screen pop up that lets you print.

Where can an American consumer go for deeper information about consumer protection against and questions concerning third party’s use of dark patterns? Based on my experience and observations, the potential for abusive practices aren’t discovered by companies or corporations and harm done happens fast compared to recover time for a majority of ignorant, trusting customers.