According to a lawsuit filed by the FTC, an international network of corporations and individuals put consumers through the wringer with false claims about “free” trial offers, followed by unauthorized charges to their accounts. What’s more, the complaint alleges that the defendants used shell companies and straw owners to engage in credit card laundering – the practice of circumventing credit card associations’ fraud-monitoring programs in an effort to avoid detection by consumers and law enforcers.

It’s unusual for a lawsuit to include two exhibits just to list the names of the companies the defendants allegedly used to mask what they were really up to, but from Alpha Group LLC to Zoom Media Ltd, that’s what you’ll find attached to the FTC’s complaint against Apex Capital Group, 11 UK corporations, Phillip Peikos, and David Barnett. The defendants had more than a thousand websites, and used many of them to market at least 50 products advertised to – among other things – cause weight loss, build muscles, grow hair, improve sexual performance, and sharpen cognition.

It’s unusual for a lawsuit to include two exhibits just to list the names of the companies the defendants allegedly used to mask what they were really up to, but from Alpha Group LLC to Zoom Media Ltd, that’s what you’ll find attached to the FTC’s complaint against Apex Capital Group, 11 UK corporations, Phillip Peikos, and David Barnett. The defendants had more than a thousand websites, and used many of them to market at least 50 products advertised to – among other things – cause weight loss, build muscles, grow hair, improve sexual performance, and sharpen cognition.

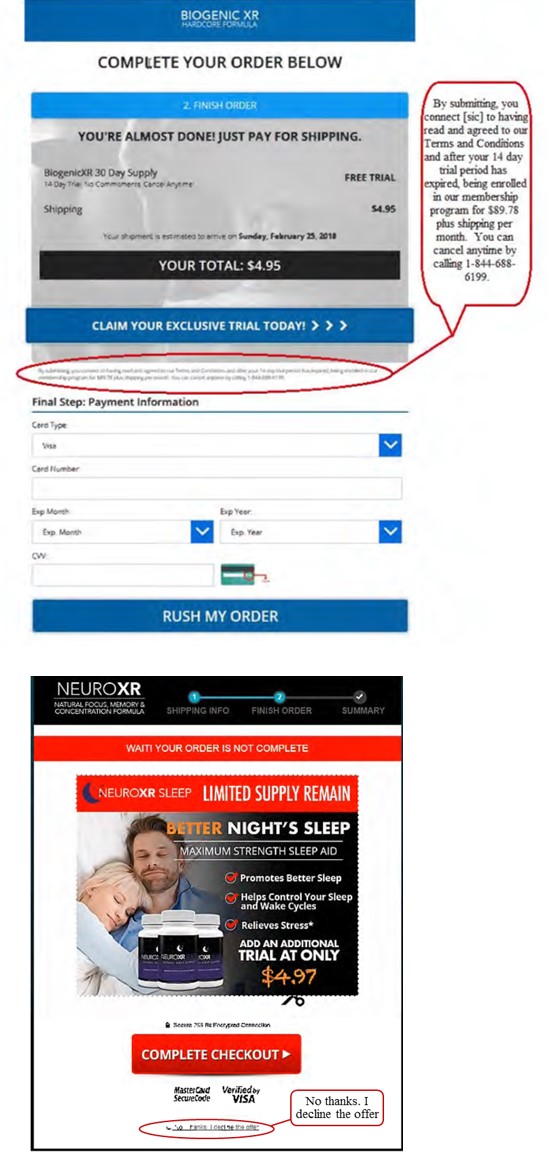

On many of those sites, the defendants’ modus operandi was to lure consumers in with a “free” or “risk free” trial purportedly available for a shipping and handling fee of $4.95. But the FTC says the true nature of the transaction either wasn’t disclosed or was buried in hard-to-read and hard-to-find fine print. As a result, consumers were in for a surprise about two weeks later – when they may have just received the item – to learn their credit or debit cards were dinged for the full price of the product, usually about $90. Until consumers were able to reach the defendants and cancel – not an easy feat – more shipments and more charges kept coming.

On many of those sites, the defendants’ modus operandi was to lure consumers in with a “free” or “risk free” trial purportedly available for a shipping and handling fee of $4.95. But the FTC says the true nature of the transaction either wasn’t disclosed or was buried in hard-to-read and hard-to-find fine print. As a result, consumers were in for a surprise about two weeks later – when they may have just received the item – to learn their credit or debit cards were dinged for the full price of the product, usually about $90. Until consumers were able to reach the defendants and cancel – not an easy feat – more shipments and more charges kept coming.

That’s not the only way the FTC says the defendants soaked consumers. During the initial transaction, consumers who clicked on the “COMPLETE CHECKOUT” button thought it was just the final step in the trial offer. But it triggered a second undisclosed (or poorly disclosed) negative option, resulting in even more unauthorized charges to unsuspecting consumers’ credit and debit cards. In other words, consumers found themselves enrolled without their consent in not one but two automatic shipment programs.

What if consumers tried to turn off the lather-rinse-repeat cycle of monthly billing? The FTC says the defendants made it difficult. For many consumers, just trying to reach a customer service representative was a challenge. Once they found a phone number, some people were left on hold for an hour or longer. And even when they expressly told the defendants to stop sending merchandise, some consumers say the unwanted shipments – and unauthorized charges – continued.

Consumers requesting refunds were left similarly agitated. Some were told the refund period had expired or that they could get their money back only if they returned the trial product unopened. And in numerous instances, consumers were told to send packages back to a return address that wasn’t the defendants’ real address.

According to the complaint, the defendants’ misleading “free” trials, undisclosed continuity plans, and unauthorized charges violated the FTC Act, the Restore Online Shoppers’ Confidence Act (ROSCA), and the Electronic Fund Transfer Act.

The FTC also alleges the defendants used straw owners, shell companies, altered documents, and other techniques in an effort to evade credit card companies’ internal anti-fraud efforts. You’ll want to read the complaint for the specifics, but here’s just one example. Applications for merchant accounts filed on the defendants’ behalf didn’t list them as the owners. Instead, the paperwork named 13 other individuals, some of whom were relatives or neighbors of an Apex Capital Group employee. The FTC says those people got a monthly “commission” of $1,000 from Apex’s account, but didn’t engage in any actual business. According to the complaint, the defendants’ credit card laundering efforts were unfair practices, in violation of the FTC Act.

A federal court in California has issued a temporary restraining order halting defendants’ alleged illegal conduct, appointed a receiver over the corporate defendants, and frozen the defendants’ assets. The case should serve as a reminder that ROSCA violations won’t just come out in the wash. If you use negative options in your online marketing, don’t hide the dirty laundry. The law requires that you: 1) clearly and conspicuously disclose all material terms of the transaction before obtaining consumers’ billing information; 2) get consumers’ express informed consent before making the charge; and 3) provide a simple mechanism for stopping recurring charges.

In reply to I have been waiting for a by Leon Hudson

You can tell the FTC about a problem you have with a business, and we may use that information for investigations. The FTC doesn't take cases for people one at a time. You could ask your state attorney general for help. Use this list to find your state attorney general. You can report to the FTC at www.FTC.gov/Complaint.

In reply to I have gone through this as by Kim Worcester

In reply to I have gotten offers for a by Margaret Suraci

You can report that to the FTC at www.ReportFraud.ftc.gov. The information you give goes into a secure database that the FTC and other law enforcement agencies use for investigations.